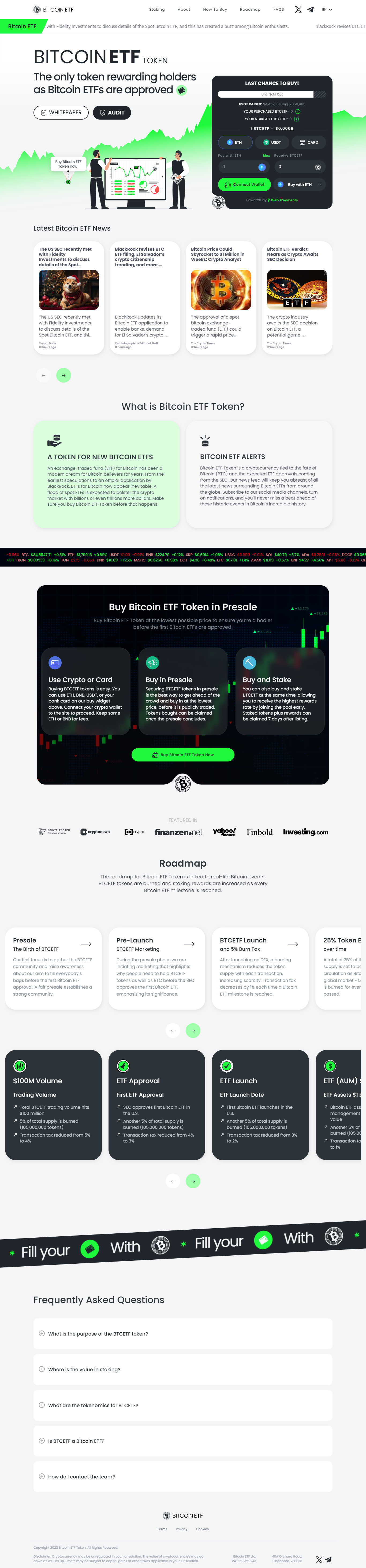

Bitcoin ETF Token™ | Home | Official Site

What Is Bitcoin ETF Token?

BTC ETF Token is a cryptocurrency project that aims to provide traders and investors with an opportunity to speculate on the potential launch and market impacts of the first spot Bitcoin Exchange-Traded Fund (ETF) in the United States. The project is not officially affiliated with the spot Bitcoin ETFs currently under review by the United States Securities and Exchange Commission (SEC).

BTC ETF Token offers a unique value proposition by aligning its token supply and features with key milestones in the Bitcoin ETF approval process. As each milestone is reached, such as an ETF approval date being announced or the first ETF going live for trading, a portion of BTC ETF Token's total supply will be burned. This deflationary mechanism aims to increase scarcity and incentivize long-term holding of the token.

Key Features and Mechanisms of BTC ETF Token:

Deflationary Mechanism: BTC ETF Token incorporates a deflationary mechanism where 25% of the total token supply will be burned over time, reducing the supply from 2.1 billion BTC ETF to 1.57 billion BTC ETF. This mechanism aims to increase scarcity and potentially drive the value of the token.

Staking Rewards: The project also includes staking rewards, which dynamically increase based on the duration token holders decide to lock up their tokens. Currently, 25% of the total supply is allocated for staking, promoting network security and stability. The staking rewards are set to decrease as more BTC ETF tokens are pledged.

Presale and Token Distribution:

BTC ETF Token conducted a presale to attract early supporters and establish a robust community. The presale was split into ten stages, with each stage having its own token price. Early backers had the opportunity to acquire tokens at advantageous pricing. The presale aimed to kickstart awareness of the project's unique value proposition aligned with spot BTC ETF milestones.

Liquidity and Transaction Tax Reduction:

Once the presale ends, BTC ETF Token plans to launch the tokens on decentralized exchanges (DEXs) to democratize access. Upon launch, 10% of the total BTC ETF supply will be used to provide liquidity. Additionally, a token-burning mechanism in the form of a sell tax will be implemented. Initially, every BTC ETF transaction will be subject to a 5% tax, with 5% of the transacted tokens being destroyed. However, as real-world milestones are achieved, such as the first BTC ETF approval, the transaction tax will decrease by 1% until it reaches 0%.

Potential Benefits and Risks:

Speculation and Exposure: BTC ETF Token allows investors to participate in the speculation and excitement surrounding the potential approval and launch of a spot Bitcoin ETF. By holding the token, investors can potentially benefit from positive market impacts resulting from ETF milestones.

Deflationary and Scarcity: The deflationary mechanism and token burn approach aim to increase scarcity and potentially drive the value of BTC ETF Token over time. This may benefit long-term holders of the token.

High-Risk Investment: It is important to note that investing in crypto assets, including BTC ETF Token, carries a high level of risk. Investors should conduct their own research and consider the possibility of losing money due to market volatility and other factors.